SCAM-PROOF YOUR FINANCES: ESSENTIAL TIPS TO AVOID GETTING TRICKED

Scam-Proof Your Finances: Essential Tips to Avoid Getting Tricked

|

| Scammer |

1. Introduction

- Why scams are on the rise in Malaysia

- Shocking statistics on financial fraud

- Why everyone is a potential target

2. Common Types of Scams in Malaysia

- Online shopping scams

- Investment and Ponzi schemes

- Phishing and bank impersonation scams

- Love and romance scams

- Job offer and work-from-home scams

- Fake charity and donation scams

3. How to Identify a Scam: Key Red Flags

- Too-good-to-be-true offers

- High-pressure tactics and urgency

- Requests for upfront payment or personal information

- Unverified sources and suspicious links

4. Real-Life Scam Stories: Lessons to Learn

- Case study: A retiree losing savings to an investment scam

- Case study: A business owner tricked by a fake supplier

- What went wrong and how to avoid similar traps

5. How to Safeguard Your Money and Personal Information

- Verifying sources and doing background checks

- Using secure payment methods

- Strengthening online security (passwords, 2FA, etc.)

- Being cautious with phone calls, emails, and social media messages

6. What to Do If You’ve Been Scammed

- How to report scams in Malaysia (e.g., CCID, Bank Negara)

- Steps to recover your money (if possible)

- How to prevent future scams

7. Conclusion: Stay Alert & Educated

- Recap of key points

- Encouraging readers to share experiences and tips

Introduction

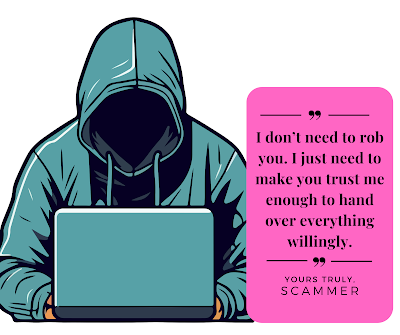

Do you think you are too smart to be scammed? Most victims thought the same— until they lost significant amounts of money. Scammers are becoming more sophisticated, using psychological tricks and advanced technology to deceive even the most cautious individuals.

In recent years, Malaysia has witnessed a significant surge in financial scams, leading to substantial economic losses and emotional distress among victims. The State of Scam Report 2024 revealed that Malaysia lost a staggering RM54.02 billion to scams in just one year, accounting for approximately 3% of the nation's GDP. (Source: Click here)

With the rise of online shopping, digital banking, and investment platforms, fraudsters have more opportunities than ever to exploit unsuspecting individuals. This alarming trend underscores the urgent need for heightened awareness and proactive measures to protect oneself from falling prey to fraudulent schemes.

This guide will help you identify scams, recognize warning signs, and take steps to safeguard your finances.

Common Types of Scams in Malaysia

Understanding the various scams prevalent in Malaysia is the first step toward safeguarding your finances. Here are some of the most common scams:

1. Online Shopping Scams

Fraudsters create fake e-commerce websites or social media profiles, luring consumers with attractive deals. Victims make payments but never receive the purchased items.

2. Investment and Ponzi Schemes

Scammers promise high returns with little to no risk, enticing individuals to invest in non-existent ventures. These schemes often collapse, leaving investors with significant losses.

A Johor contractor lost RM688,000 in a scam promising a 410% return. He only realized it was fraudulent when he could no longer withdraw his 'profits.' (The Rakyat Post)

3. Phishing and Bank Impersonation Scams

Cybercriminals send emails or messages posing as reputable institutions, tricking individuals into revealing personal information or transferring funds.

4. Love and Romance Scams

Perpetrators build fake online relationships to gain victims' trust, eventually manipulating them into sending money. A notable case involved a woman who lost RM2.2 million over seven years to an online lover she never met. (The Star)

5. Job Offer and Work-From-Home Scams

Scammers offer lucrative job opportunities requiring upfront fees for training or equipment, but the jobs do not exist.

6. Fake Charity and Donation Scams

Fraudsters solicit donations for bogus charities, especially during disasters or crises, exploiting the goodwill of the public.

How to Identify a Scam: Key Red Flags

Recognizing the warning signs of a scam can prevent you from becoming a victim. Be cautious if you encounter the following:

- Too-Good-To-Be-True Offers: Promises of high returns with minimal risk are often fraudulent.

- High-Pressure Tactics and Urgency: Scammers create a sense of urgency to prompt hasty decisions.

- Requests for Upfront Payment or Personal Information: Legitimate entities typically do not ask for sensitive information or payments without proper documentation.

- Unverified Sources and Suspicious Links: Be wary of unsolicited communications containing links or attachments.

Real-Life Scam Stories: Lessons to Learn

Learning from real-life incidents can provide valuable insights into avoiding scams.

Case Study 1: The Love Scam

In December 2024, a Malaysian woman lost over RM2.2 million in a seven-year-long love scam. The scammer, posing as a U.S. citizen, convinced her to transfer funds under various pretexts, despite never meeting in person.

Lesson: Always verify the identity of online acquaintances and avoid sending money to individuals you have not met personally.

Case Study 2: The Investment Scam

A Johor-based contractor was swindled out of RM688,000 in an investment scam promising a 410% return. The victim was enticed by the prospect of high profits and invested substantial sums before realizing it was a fraud.

Lesson: Be skeptical of investment opportunities that guarantee exorbitant returns with little risk.

How to Safeguard Your Money and Personal Information

Protecting yourself involves adopting proactive measures:

- Verify Sources and Conduct Background Checks: Research and confirm the legitimacy of companies or individuals before engaging in transactions.

- Use Secure Payment Methods: Opt for payment methods that offer fraud protection and avoid direct bank transfers to unknown parties.

- Strengthen Online Security: Utilize strong, unique passwords and enable two-factor authentication on all accounts.

- Exercise Caution with Communications: Be wary of unsolicited calls, emails, or messages requesting personal information or payments.

What to Do If You’ve Been Scammed

If you fall victim to a scam:

1. Report the Incident: Contact local authorities and file a report with the relevant agencies, such as the National Scam Response Centre.

2. Notify Financial Institutions: Inform your bank or credit card company to halt transactions and monitor for suspicious activity.

3. Document All Correspondence: Keep records of all communications and transactions related to the scam.

4. Seek Support: Reach out to support groups or counseling services to cope with the emotional impact.

Conclusion: Stay Alert & Educated

Scammers continually adapt their tactics, making vigilance and education crucial in protecting your finances. By staying informed about common scams and implementing preventive measures, you can reduce the risk of falling victim to fraudulent schemes.

Disclaimer:

The information provided in this blog is for educational purposes only and does not constitute legal or financial advice. Readers are encouraged to consult with professional advisors for specific guidance related to their individual circumstances.

Comments

Post a Comment