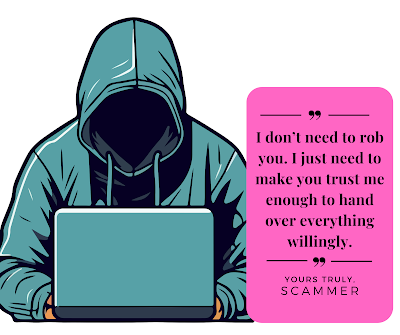

SCAM-PROOF YOUR FINANCES: ESSENTIAL TIPS TO AVOID GETTING TRICKED

Scam-Proof Your Finances: Essential Tips to Avoid Getting Tricked Scammer 1. Introduction - Why scams are on the rise in Malaysia - Shocking statistics on financial fraud - Why everyone is a potential target 2. Common Types of Scams in Malaysia - Online shopping scams - Investment and Ponzi schemes - Phishing and bank impersonation scams - Love and romance scams - Job offer and work-from-home scams - Fake charity and donation scams 3. How to Identify a Scam: Key Red Flags - Too-good-to-be-true offers - High-pressure tactics and urgency - Requests for upfront payment or personal information - Unverified sources and suspicious links 4. Real-Life ...